This article was originally published by Adweek.

A stay-at-home parent with young children and an elementary school teacher may use the same Clorox product, but prefer different advertisements.

The brand needed to find a way to reach individual consumers with customized messaging, but before July 2020, when it consolidated all media with Omnicom’s largest media agency, OMD, it relied on disconnected data to plan and execute on its media strategy. The Clorox marketing team used syndicated data from companies like MRI to understand target audiences’ purchase behavior, and its agencies tapped into data on media consumption habits. But as it was, there was no way to send personal messages to individual consumers, making it harder for the brand to build connections with all the people who buy Clorox products for similar but slightly different reasons.

“[The data wasn’t] built around something that we know about a person. And probably more importantly, the data that we use for insights into planning couldn’t be connected to activation,” said Doug Milliken, vp of marketing transformation at Clorox.

This changed last year when the brand fully implemented Omnicom’s technology platform, Omni, and experienced both record spending and the highest return on marketing investment in its history. Increased consumer interest in cleaning supplies during the pandemic inevitably drove some of that success, but Milliken attributes much of it to Omni.

Omni stood out from others during Clorox’s 2020 media review. “It wasn’t the only reason for consolidating into Omnicom, but it was a significant factor,” Milliken said. The brand spends $300 million on media in the U.S., according to COMvergence.

OMD’s ability to build audiences, get insights on them, personalize against them, build a plan around them and then buy them made the agency’s approach unique. This process is a more responsive way of handling planning and delivery, Milliken said, than “a huge annual set it and forget it” process. This way, the company can still set strategic annual goals, but approach quarterly execution more fluidly.

Building an Agency Tech Stack

In recent years, holding companies began rolling out technology platforms to power research and activate media. Some holding companies acquired data companies to simplify scaling their platforms. For instance, Interpublic Group purchased Acxiom, Publicis added Sapient and Epsilon and Dentsu snagged Merkle. According to Forrester Research data, agency holding companies invested approximately $12 billion in technology acquisitions between 2014 and 2019.

Others decided to build their own technology. This was the case with Omnicom, which debuted its operating system, Omni, in 2018. Horizon Media, Havas, Stagwell and WPP also have proprietary technology platforms.

Customizing Omni

Omnicom’s data and analytics unit Annalect began developing Omni a decade ago and continues to build and update the system.

Seb Hernoux, OMD USA’s chief data and technology officer, explained that Omnicom can customize the platform to its needs because its product and engineering teams hard-coded the agency teams’ ways of working and process into the platform.

Because of this level of of integration, media teams across any Omnicom agency can connect planning, investment and marketing science and view the entire process in a single online environment. It also protects clients’ data privacy, since the agency creates a separate “instance” on the platform for each client.

“We want this to be the central source of information that we use across all of the teams,” said Ellen Griffin, OMD managing director and Clorox account lead, adding Omni doesn’t build disparate or different audiences off of different information. “It allows us to very easily give [the data] to a creative agency that maybe is not an Omnicom agency or to clients to also use.”

In-depth planning

Using Omni, Omnicom’s media agencies can build out audiences in alignment with a client’s campaign goals. It’s easy to do, making it simple for media teams across the agencies to learn how to use the technology.

Boolean Logic—the notion that all values are either true or false—fuels the platform. By linking together a few statements, planners can access thousands of data attributes that shape a brand’s understanding of its target audience and and shine a light on an individual consumer’s habits and interests. Then, the media agency can pass those insights off to the brand’s creative partner to inform messaging and build a media plan.

Teams do this using Omni’s Audience Explorer tool. An integrated planning team that leverages the tool can find advanced audience data across several categories, like apparel, auto or beauty, and view demographic data, advanced audience data, purchase behavior, location data, TV viewership data or browsing behavior. These datasets help the Clorox team understand a consumer—their interests, health and cleaning habits, what other products they’ve purchased and the topics they search for online. In addition to its outside data sources, Omni ingests its clients’ first-party data and builds it into the audience segments.

With third-party cookie deprecation on the horizon, Omni avoids sourcing cookie-based data. Offline data sources and large panels power the platform. The Clorox team is working with data clean rooms on the publisher side, as well as Amazon and Google, which play critical roles in Clorox’s sales funnel. It also partners with neutral clean rooms, powered by companies like Snowflake or InfoSum. Omni’s connected environment makes data clean rooms accessible, allowing publisher, client and Omni data to live in a protected environment with agreed upon use cases and applications.

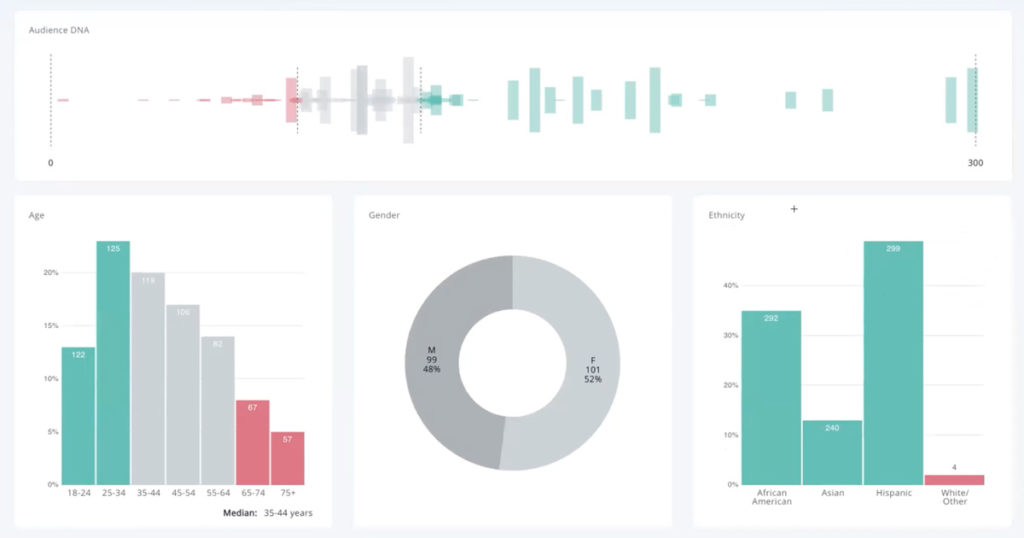

Once the team completes the audience build, Omni almost instantaneously models the data, allowing the planner to visualize audience attributes by age, gender, ethnicity, education level, number of children, marital status, income, location, interests, media consumption and more. The platform also indicates where a brand’s target audiences are over or under indexing. For example, if a planner sees that a particular audience is over indexing for an interest in soccer, they may buy media on certain sports channels. If a particular demographic under indexes, a planner knows to avoid those consumers.

Omni also enables filtering audience data by category so a team can view specific details, like what car models an audience segment is most interested in purchasing. Comparing datasets is also possible. In one instance, the Clorox team analyzed an audience of parents, non-parents and empty-nesters to determine if the three categories had any interests in common. This tactic is beneficial if a media team is planning a big campaign and wants to place it on a channel where all three audiences might see it.

Clorox isn’t utilizing all of Omni’s features. According to Jay Pattisall, principal analyst at Forrester Research, Omni can also identify macro trends in consumer culture, pinpoint the kinds of content that target audiences consume and employ an AI-driven content management capability to find relevant content to serve to those audiences.

“The Omni platform began very much as a media tool, but over time it has developed more functionality and is inclusive of a number of different Omnicom tools that have been developed across the network and brought into this overall operating system, which is essentially what it is today,” said Pattisall.

Predicting the most cost-effective buys

After the planner completes a custom audience build, the team can identify the channels it would like to include in a campaign. The platform can then allocate a campaign budget across those channels and set minimum and maximum spend ranges for each. Recommendations shed light on whether or not a campaign is accomplishing its intended goals. In one instance, the platform’s recommendation prompted the Clorox team to consider if a media plan would drive buying intent as intended, or increase product awareness. Then, the team adjusted its goals accordingly.

Omni activates the media by recommending which digital channels to buy media from. The platform estimates reach and cost metrics, and includes a live feed showing available inventory at individual publishers and the cost of reaching a desired audience at each one. For example, the Clorox team can see if it will be more cost effective to buy media on a publication like Reddit or Accuweather and still reach the desired audience, ultimately saving the client money.

This level of granularity in planning is fundamental to Clorox’s goals. Before Omni, “it was really hard for us to be truly people centered in our media, because the data sources that were used in the business were really built around sort of large groups of aggregated people,” Milliken said.

The consolidated platform

With brands increasingly consolidating media and creative to trim down the agencies on their roster, a technology platform that can bind the agency brands together could be an attractive partner to have for a brand that wants a simplified marketing approach.

Other agencies have similar technology offerings, according to Pattisall, but what sets Omni apart from the others is that all of Omnicom’s technology is integrated in the platform.

“That’s not to say that an Omnicom competitor doesn’t have those tools,” he said. “They have them separately—that’s a difference. Omni has put everything into its Omni suite of tools.”